Home Buyer Information

Whether you are a first time home buyer or seasoned in the real estate market, we offer information specific to meet your needs.

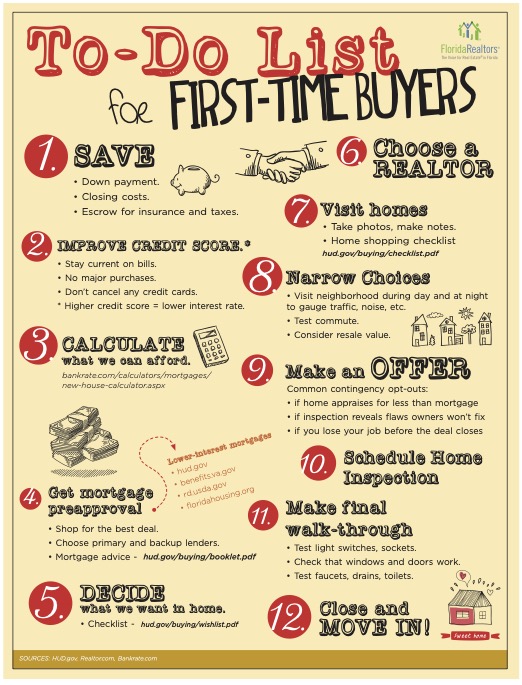

First time home buyer packages include a step by step financial guide to get you on track and make the home purchase process as smooth as possible.

First Time Home Buyer Advice:

LUCKY YOU! Below you will find advice from our personal experiences through purchasing our own homes and working with first time home buyers. This is a guide to assist you but remember, we are here to help you every step of the way to HOMEOWNERSHIP!

Get your finances in order.

- You MUST get serious about your budget. What are you REALLY spending your money on? If you are planning to purchase a home with a partner, friend, or family member they also need to get serious about budgeting.

- You want your new home to be a blessing, not a curse, right? You and your partner (co-owner if applicable) must go over these questions:

- You do not necessarily need to put 20% down. Ask yourself, can I make at least a 10% down payment?

- Can I keep the house payments at or below 25% of my monthly take-home pay?

Research some good budget & financial savings classes. Contact your realtor or lender for suggestions.

- The first 3 Baby Steps

- Get $1000 in a savings account for emergencies

- Start working on getting out of debt, starting at the smallest debt to the biggest. Get rid of all those small balances and close those accounts, cut up the cards and throw them away. (SERIOUSLY!) (This step will take most people a very long time, once you are not paying on your debt every month you will be able to begin saving money quickly)

- 2nd savings account with 3-6 months of your expenses

- Some other things to consider:

- You may want to start a file/folder with information

- What is your income? Save your paycheck stubs, and W-2s, put them in folder

- What is your credit score? Good score to be over 580

- If you owe any utility companies pay them off – get receipts showing they are paid off – put in folder

- Any debt or collection account that has been paid off, get the receipt it has been paid off and put in the folder

- What is your debt-to-income ratio? You want to show you can pay your loan and the rest of your bills

- Do you have rental history? If so, get the dates of the lease, landlord/property manager information and any roommates names, possibly copies of lease agreements – all will need to be verified – put copies of lease agreements in the folder

- Any savings, IRA’s, retirement, 401k information – put copies of all these documents in the folder

All Buyers:

Loan Programs Available to Home Buyers:

Contact our in house lender Danielle DeSousa to get Pre approved

USDA 100% Financing Program:

- Zero down payment,

- 640 minimum credit score

- Property must be located in targeted area.

- Income restrictions apply. Check income eligibility.

- NO PMI or Private Mortgage Insurance

- Seller can pay 6% of purchase price toward closing costs

FHA Program

- Low down payment

- 620 minimum credit score

- Kiddie condo option: Parents or family member can co-sign on loan

- Lower down payment than standard FHA program is available in Alabama, Florida, Georgia,

Illinois, Indiana, Kentucky, Mississippi, North Carolina, South Carolina, Tennessee if you

purchase FHA Foreclosure - Down payment can be 100% gift or down payment assistance or grant funds

- Seller can pay 6% of purchase price toward closing costs Good Neighbor Next Door

- Get home at 50% discount on home in target areas.

- Must be law enforcement, police officer, teacher, firefighter, or emergency medical technician

to be eligible for this program - Low Down Payment Option available in HUD Participating Communities.

Home Possible Neighborhood Solution Program

- You may be eligible for this program if you are a Teacher, Law Enforcement Officer, Firefighter, Healthcare Worker, Nurse, Emergency Medical Technician (EMT), or Military Personnel

- 620 Credit Score

- Reduced mortgage insurance which means lower monthly mortgage payment

- Flexible Qualification Guidelines

VA Loan

- 0 down payment

- Great fixed rate loan program with 0 Down Payment for veterans or active military personnel

in Army, Navy, Marine Corps, Air Force, Coast Guard, and National Guard. Reservists

eligible with 6 years service. - 620 minimum credit score

- No maximum loan limit

- Single family home-VA approved condo-townhome

FHA Streamline 203k Renovation Loan

- Repairs which range from $5,000-$35,000+ may be included in loan amount.

- Great program to fix up foreclosures.

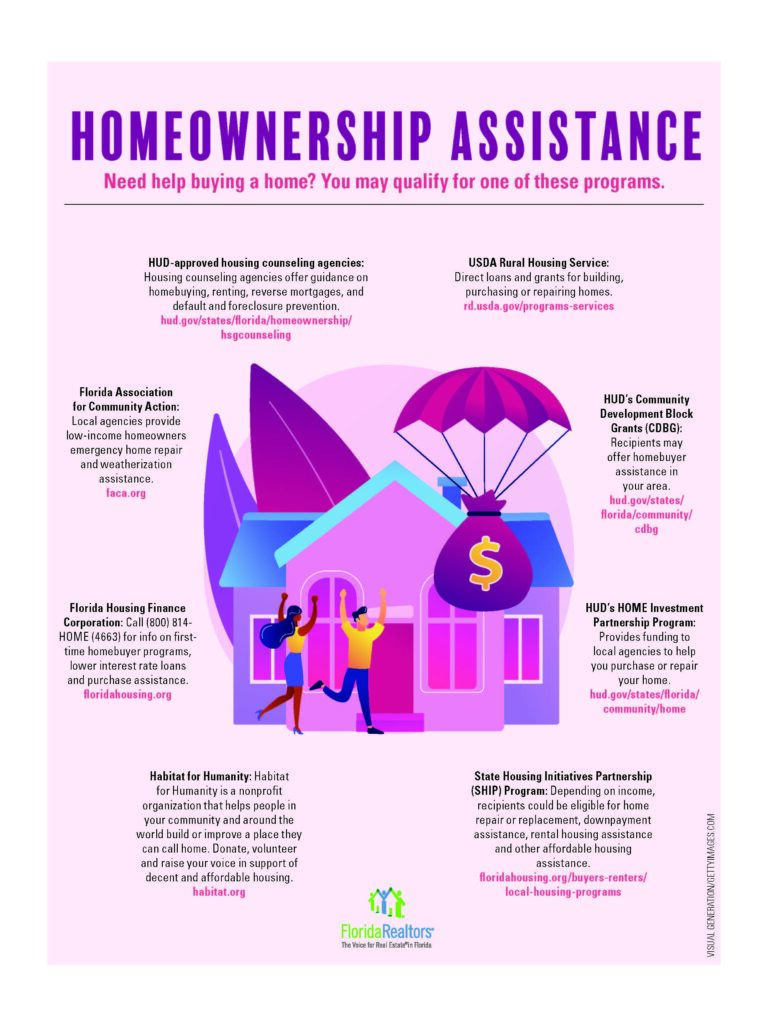

Home Purchasing Assistance Programs in Flagler County:

Mid-Florida Housing Partnership Inc. SHIP Program:

Assistance for low-income families to help with home purchase, must qualify. Contact: (800) 644-6125 Ext. 301

HomePath.com is the official Website for Fannie Mae-owned properties. A foreclosed property can represent a great opportunity and a good value — but a HomePath property can offer even more. Some homes may qualify for special incentives, which will be clearly indicated on the property details page of an eligible property. Their goal is to sell properties in a timely manner in order to minimize the impact on the neighborhood. Additional assistance to the buyer be available.

HELPFUL TERMS WHEN IT COMES TO BUYING A HOME

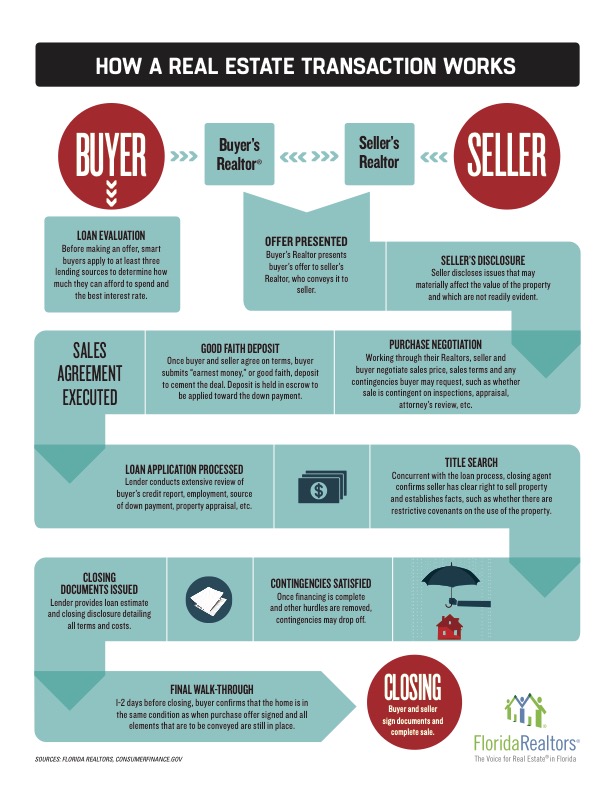

What Is a Reasonable Offer? Unless you are very familiar with your area and completely understand how to price an offer on your first home, you might want to consider getting help from an expert. A real estate agent can be very helpful in deciding how much your offer should be. In today’s buyers market, your best reasonable offer might actually be lower than you would think. Have your real estate agent run comparable sales in your area and pay attention to prices per square foot for recent sales. This can give you a very good idea of how much to offer.

What Is a Purchase Agreement? The purchase agreement sets the amount of your offer and usually includes extra details, such as which appliances stay, who pays closing costs (seller can pay closing costs on some home loans) and when you’d like to take possession of the house. The seller (or selling agent) will have you sign the purchase agreement and offer “earnest money.” Earnest money is a deposit showing that you’re serious about your offer to buy the home; it’s usually three percent of the asking price and later applied as part of your down payment or other closing costs. It is a check that your agent holds on to until the offer has been accepted. Title companies can also prepare a purchase agreement.

Should You Have the Home Inspected? Yes, you should. You should never buy a home without inspecting it, and most purchase agreements are contingent upon inspection. Spend a few hundred dollars and hire a qualified/licensed professional to inspect your new home (before you buy it) — it’s the only real way to ensure the home is in good condition. The home inspector should provide a very detailed summary report listing the condition of each item, and recommending repairs. You should always be there when the home inspection takes place. It usually takes a few hours and you’ll learn not only about the condition of the house but how everything works. Ask questions as you go along. If there are problems, the seller may adjust the purchase price of the home or simply repair the problems.

Do You Need Homeowner’s Insurance? Yes, you’ll need a valid homeowner’s insurance policy before you close on your home. You can’t get a mortgage without it.

What Are Closing Costs? This is probably the top asked question by first-time home buyers. All loan originators are required by law to disclose in writing your estimated closing costs and fees, so you’ll know ahead of time. This estimate is commonly called a “good faith estimate.” Keep in mind, various additional costs might apply depending on your state, mortgage type, and down payment amount.

WHAT YOU NEED BEFORE CLOSING:

You will receive a document that outlines the actual costs you’ll pay at closing. You’ll be asked to bring a valid picture ID, a certified check (if applicable) for any down payment due (or you may have to wire the money to the title company) and any other additional documents that your circumstances may require.

Be sure to ask for and to take a final walk through of the property shortly before the closing to make sure the home is in the condition you expect it to be.

Any number of people may attend the closing—you, your lender, the seller, the seller’s mortgage holder, respective attorneys, the real estate agent, the transfer agent (if it’s a co-op), the managing agent (if it’s a condo) and the title company representative. Once everyone signs the appropriate documents and the checks are exchanged, you’ll be given the keys to your home and that’s it!

Remember, we are full time Realtors and are able to assist you every step of the way.

Feel free to contact us at 386.597.0047 or email us at info@DontWorryLiveHappy.com.

Congratulations on taking the first step to home ownership- getting educated!